Choosing a Business Structure

Main Content

Determining how to legally structure your new business is one of the most important decisions you’ll need to make when starting a business in the state of Illinois. Your decision will heavily affect your business on a host of matters, including how much control you have over the business, the level of personal liability you will carry, and the taxes you have to pay. The information below will provide you with a summary of the differences between the most common forms of business entities.

CONSIDERATIONS

Control

Do you feel the need to have total control of your business? Sole proprietorship provides you with complete authority over the management and operations of your business, whereas a corporation is controlled by directors who are elected by shareholders. Partnerships provide each partner with equal power, and LLCs have operating agreements that outline management policies.

Liability

Generally, if your business will be participating in risky or threatening activities, then you want to minimize any potential personal liability you will have if problems arise. A sole proprietorship offers the least personal protection because the owner has unlimited liability. Corporations and LLCs provide owners with limited liability that helps to protect your personal assets from individuals seeking claims against your business.

Taxes

All business types must file an annual return. Sole proprietors, partnerships, and LLCs are pass-through tax entities, which means they must pay taxes on all net profits for the year. In contrast, owners of a corporation only pay taxes on the income they earn from the corporation such as salaries, dividends, or bonuses. Keep in mind that the corporation is a separate tax entity, and it must pay additional taxes on any profits remaining at the end of the year.

Complexity

The sole proprietorship is by far, the easiest type of business to establish. You don’t have to file any paperwork with the state or pay large fees to start your business. Choosing to structure your business as an LLC or corporation can be complex and expensive. You will need to file documents with the state and pay fees ranging from $50 to $800 depending on where you organize your business. Additionally, you will need to elect officers, hold meetings, and maintain records. Questions to ask yourself when selecting a business structure:

- How much control do you wish to have?

- How will you protect your personal assets?

- How much risk is your business willing to absorb?

- How do you want to be taxed?

- Will you need to access business earnings for personal reasons?

- Which legal structure will provide you with the most flexibility?

- What will happen to the business if you experience an unexpected hardship and are unable to run the company?

TYPES OF BUSINESS STRUCTURES

Each business structure has certain advantages and disadvantages that you should consider. The information below will provide you with a summary of each type of structure.

Sole Proprietor

Most small businesses are owned by a single individual and referred to as a sole proprietorship. Usually, the owner is responsible for the day-to-day management of the business. Sole proprietors own all the assets and profits earned by the business, but they also assume complete liability.

Advantages of a Sole Proprietorship

- Simple and least expensive business structure to organize.

- Complete control over all decisions regarding the business.

- Receives all profits generated from the business.

- Reports profit or loss on personal income tax returns.

Disadvantages of a Sole Proprietorship

- If operating a business under a name other than the owner's own personal name, the business name will need to be registered. Business names are registered by filing an Assumed Business Name Notice (sometimes referred to as a DBA, Doing Business As Name, or Fictitious Business Name) with the local county clerk's office, in the county where the business is located. Registering requires running a legal notice in a local newspaper for three consecutive weeks.

- The law does not distinguish between the business and its owner.

- Sole proprietors have unlimited liability and their business and personal assets are at risk.

- Businesses may dissolve upon the withdrawal or death of an owner.

A Sole Proprietorship will likely need registering with the County.

Partnership

Partnerships are similar to starting a sole proprietorship, except that two or more people share ownership of the business. The partners will need to establish a legal agreement that states how the business will be run to avoid future disputes between partners.

Advantages of a Partnership

- Simple and inexpensive business structure to organize.

- Raising capital may prove to be easier with a partnership.

- Partners may have complementary skills to contribute to the business.

- Reports profit or loss on personal income tax returns.

Disadvantages of a Partnership

- Each partner is individually liable for the actions of the other partners.

- Less control, as decisions, must be shared among partners.

- Business names are registered by filing an Assumed Business Name Notice with the county clerk, in the county where the business is located.

- Profits must be shared.

- The business may dissolve upon the withdrawal or death of a partner.

A Partnership will likely need registering with the County.

Corporation

Similar to an individual, a corporation is a legal entity that can be taxed and held legally liable for its actions. Corporations are created by filing the Articles of Incorporation with the Illinois Secretary of State's Office. Maintaining a corporation requires compliance with a multitude of regulations and tax requirements. The owners of a corporation are simply shareholders that help to elect a board of directors that manage the business. The corporation does not dissolve when ownership changes.

Advantages of a Corporation

- Shareholders enjoy limited liability.

- Raising additional funds is possible through the sale of stock.

- Can deduct the cost of benefits it provides to officers and employees.

Disadvantages of a Corporation

- Organizing a corporation is the most expensive and time-consuming business structure to form.

- A high level of paperwork is needed as corporations must comply with regulations from federal, state, and local agencies.

- Filing of an annual report.

- May result in higher overall taxes. Dividends paid to shareholders may be taxed twice.

Read the guide for organizing an Illinois Corporation

Limited Liability Company (LLC)

The LLC is a hybrid legal structure, created with the Secretary of State, that provides the tax flexibility of a sole proprietorship (depending on how many owners there are), and the limited liability protection of a corporation. Organizing an LLC is more difficult and formal than that of a general partnership.

Advantages of an LLC

- Offers business owner(s) limited liability protection.

- Can report profit or loss on personal income returns.

- Typically less paperwork than a corporation.

Disadvantages of an LLC

- Cost of the state filing fee.

- Businesses may dissolve upon the withdrawal or death of the owner or a member.

- Filing of an annual report.

- More paperwork than a sole proprietorship.

Read the guide for organizing an Illinois LLC

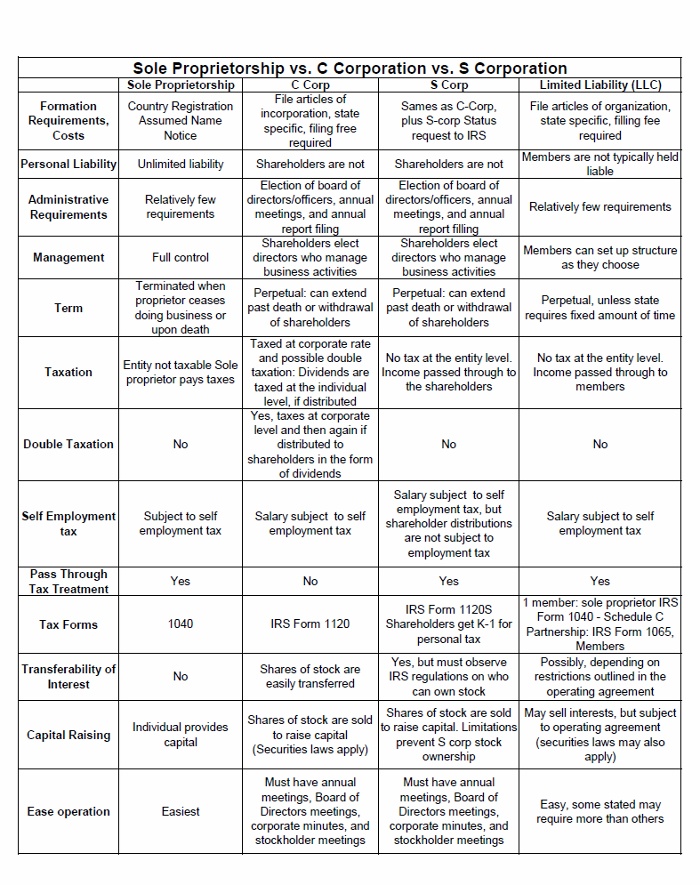

Side-by-side Comparison of Legal Structures

Download the Legal Comparison Matrix as a PDF

NEXT STEPS

One type of business entity is not necessarily better than any other but will depend on the owner and risk of the business. Before making a selection, it's a good idea to consult with your attorney, accountant, or a key adviser (like the SBDC) to assist you in the process of selecting a business structure for your company.

In addition to forming an entity, there are other potential registrations such as:

- Federal Employer Identification Number or FEIN (much like a social security number for a business) with the Internal Revenue Service,

- Illinois Business Tax Number (sometimes referred to as a sales tax permit) from the Illinois Department of Revenue to sell products and certain services

- Illinois Department of Employment Security when hiring employees

- Occupational licensing with the Illinois Department of Financial and Professional Regulations

Your initial choice of a legal business entity isn’t necessarily a permanent decision, and you can change later. If your business grows or the level of risk increases, you can always convert your business to a LLC or a corporation with the help of an attorney.

Need additional information about starting your business? Help with a business plan? Finding financing? Contact the Illinois Small Business Development Center (SBDC) at Southern Illinois University for a confidential business consultation at no charge to you. Call (618) 536-2424 to set up an appointment.